ELSTER, a success story

A constantly growing range of services since 1999

and a continuously improved service orientation of the tax administration.

ELSTER - Objectives and content of the procedure, management summary

ELSTER, a joint eGovernment project of the German tax administrations of all federal states

ELSTER is a joint eGovernment project of the German tax administrations of all federal states and the federal government under the leadership of the Bavarian State Tax Office.

ELSTER stands for the electronic taxreturnand enables efficient, modern, seamless and highly secure electronic transmission of all tax data between citizens, tax advisors, employers, local authorities, associations, tax authorities and other institutions.

The project results provided via ELSTER are the basis for modernizing and simplifying the taxation process for the benefit of all participants in the process, i.e. citizens and companies, their authorized representatives and the tax administration. In this way, paper-based procedures will be gradually replaced and the entire taxation process will be increasingly supported by electronic procedures. The use of state-of-the-art technologies will improve the quality of tax enforcement and reduce bureaucratic costs for citizens and companies.

As a central, nationwide eGovernment infrastructure, ELSTER has been providing citizens and businesses with a constantly growing range of services and continuously improving the service orientation of the tax administration around the clock, seven days a week since 1999. ELSTER makes it possible for all taxpayers to provide tax data with the help of convenient application programs and greatly simplifies communication with the tax administration.

ELSTER provides a free product for the electronic transmission of various tax data via the Internet with its online tax office.

ELSTER, your online tax office is the platform-independent service portal of the tax authorities, which enables the paperless submission of tax data via an interactive web application with maximum security, quickly and conveniently. An electronic certificate is used for authentication, which also ensures the encryption of sensitive data.

In addition to these two offers, ELSTER enables all software manufacturers to offer individually tailored tax software products for taxpayers and companies with the ERiC (ELSTER Rich Client) program library, which is also provided free of charge. ERiC enables the immediate plausibility check of input data and the secure transfer of data to the tax administration.

The ELSTER range has been continuously expanded and developed with a focus on user needs. In addition to the significant user orientation, the innovations are also characterized by continuous technology and process innovation. The ELSTER project was launched in 1996. Since the introduction of ELSTER as the official procedure for the electronic transmission of income tax returns on January 1, 1999, the project has pioneered many aspects of secure and legally binding bidirectional and nationwide standardized online communication between several million citizens and companies and the public administration. Examples of this are project milestones such as

- the introduction of a platform-independent Java-based architecture in 2002 in order to implement new web-based services such as electronic signatures or tax account queries;

- the opening of the platform-independent ElsterOnline portal in 2005 and the introduction of ElsterBASIS, ElsterPLUS and ElsterSPEZIAL for voluntary digital authentication, so that for the first time a signature by the citizen on paper can be completely dispensed with;

- the extension of the availability of the ELSTER program library ERiC for the Linux (2008) and Mac OS X (2011) operating systems;

- the introduction of highly scalable workflow controlling for ELSTER data storage based on Hadoop and Solr, which enables real-time data searches;

- the use of the new ID card (nPA) for registration in the ElsterOnline portal;

- the introduction of the e-balance sheet for the electronic transmission of company balance sheets;

- the rapid response to user uncertainty and security concerns about Java in 2013, so that the ElsterOnline portal can now also be used without a Java Plugin without having to do without the secure certificate technology;

- the introduction of the pre-filled tax return as a free Service in 2014;

- The relaunch of the ElsterOnline portal as "ELSTER: Your online tax office" with the personal "Mein ELSTER" area in 2017: ELSTER can now look back on more than 20 years of project history, in which the user experience and technology trends have always been decisive for further development. With the relaunch, this concept has been placed even more in the foreground. Usability and learnability were checked and improved for the first time with the help of extensive user experience tests (UX tests) together with the users before implementation. We also focused on the growing trend towards the use of smartphones and Tablets. Thanks to the use of responsive web design, ELSTER's online tax office can now also be used conveniently in the browser on mobile devices. ELSTER presented the ElsterSmart authentication app for mobile devices for the first time at CeBIT 2015;

- the subsequent submission of general attachments or digital documents (e.g. as evidence for the tax return upon subsequent request by the tax office) electronically via ERiC and Mein ELSTER by the taxpayer or the tax advisory professions;

- the electronic notification of income tax assessments (according to §122a AO).

ELSTER has already come very close to the major goal of closing the digital tax loop and will remain committed to this.

The so-called maturity model serves as a benchmark for measuring the level of digitalization of administrative services. The model distinguishes between levels 0-4. While at levels 0-2 no applications or data can be transmitted digitally by users to the administration, at level 3 application data and all supporting documents can be transmitted to the administration. Users can log in with a service account and receive digital notifications from the authority. In stage 4, users no longer have to provide any proof, as the application data is already available in the administration and can be reused in other administrative procedures and exchanged between authorities with the user's consent in accordance with data protection regulations.

Unlike almost all other administrations, ELSTER already fulfills level 3 and, in some cases, level 4 of the maturity model.

ELSTER - impressive user figures for a service-oriented tax administration

The ELSTER project mandate addresses the following different user groups;

- taxpayers - almost 41 million German households,

- Companies - over 3 million companies,

- tax advisors - over 90,000 members of the tax advisory professions - almost 8 million are connected to the tax administration via the power of attorney database of the chambers of tax advisors,

- Manufacturers of tax software - currently available on the market are around a dozen free products and more than 500 commercial software products, including all market-relevant manufacturers of tax and business management software - and

- the tax administration itself.

The following presentation of current user figures focuses on end users.

Since the introduction of mein ELSTER, the number of users has grown steadily. In 2020, 28.2 million electronic income tax returns were submitted using ELSTER.

Around 17 million users now use my ELSTER with the certificate file. This makes it the most popular type of registration. The new pre-filled tax return introduced in 2014 was used by almost 18 million participants by 2020, with around 300 million certificates retrieved. With the introduction of the digital income tax assessment notice in 2020, 437,000 legally binding notices had already been provided electronically by the end of 2020.

The aforementioned user figures also include electronic transmissions by authorized representatives, although these cannot be quantified in full. Around 6.6 million income tax returns were transmitted via DATEV, the IT service provider for tax consultants, in 2020. On its website, the Bundesverband der Lohnsteuerhilfevereine e.V. currently estimates that there are around 8,000 advice centers nationwide that advise more than 4 million taxpayers.

In total, over 200 million income tax returns were submitted using ELSTER in 2020.

99% of all companies and employers in Germany use ELSTER for the electronic transmission of advance VAT returns, wage tax returns and wage tax certificates. This is based on the legal obligation to use the electronic procedure introduced on 01.01.2005. The tax account query receives 150,000 queries from companies and tax consultants every day.

Number of electronic transmissions in ELSTER that took place by the end of 2020:

- approx. 639 million advance VAT returns, of which 40.7 million in 2020,

- approx. 321 million wage tax registrations, of which 18.9 million in 2020,

- approx. 792 million wage tax certificates, of which 55.9 million were issued in 2019.

- Total: 1.75 billion

ELSTER, part of the overarching KONSENS initiative at federal and state level

The KONSENS administrative agreement, which came into force on January 1, 2007, forms the basis for federal cooperation. Cooperation between the federal government and the 16 federal states is based on the "one for all" principle. This means that specialist tax procedures and the corresponding software are developed under the leadership of one federal state and used in all 16 federal states.

Milestones - the success story of ELSTER at a glance

1996 - 1997

- The heads of the automation (tax) departments of the supreme federal and state tax authorities commissioned an internal working group to investigate the requirements for electronic tax returns

- Under the leadership of the working group, the Munich Regional Tax Office is developing a modular software concept for data transmission via a central communication point on the basis of a Windows-based Client/Server architecture

1999

- Delivery of the first ELSTER client software to twelve providers of tax return programs, including DATEV e.G., Lohnsteuerhilfe Bayern e.V. and Steuersoft Saarlouis |

- Official introduction of ELSTER as a procedure for the electronic transmission of income tax returns

2000 - 2001

- Continuous expansion of the range to include wage tax returns, advance VAT returns and VAT returns, trade tax returns and the declaration for the breakdown of the trade tax assessment amount

- Introduction of individual services for cities, municipalities, districts, chambers and associations for the electronic transmission of vehicle registration data, death data, notifications in accordance with Section 45 EStG, household cash register data, etc. to the tax authorities

- Possibility to retrieve electronic tax assessment data and thus the first opportunity for automated tax assessment data reconciliation

- Introduction of the free ElsterFormular tax program

2002

- Pilot launch of the new platform-independent architecture based on the Java programming language in selected federal states and

- Introduction of electronic signatures, eliminating the need for handwritten signatures and thus the need to print out tax returns for legal reasons

2003

- Start planning a standardized electronic transmission of all common documents or documents that must be submitted due to legal regulations

2004

- Nationwide pilot start of the electronic transmission of wage tax certificates implemented by the computer center of the financial administration of the state of NRW, Düsseldorf. The pilot is being carried out with partners from the private sector and public administration.

- As an alternative to electronic transmission: pilot test by the federal states of Bremen and North Rhine-Westphalia for a separate printout of the tax return data as a barcode (to be submitted to the tax office with the tax return)

- Start planning an integrated, personalized web portal that taxpayers and tax consultants can use to carry out all transactions with the tax authorities online after registering once

- Pilot start of the electronic tax account query in Hesse, implemented by the Frankfurt Regional Tax Office

2005

- Obligation to use ELSTER for advance wage and VAT returns and wage tax certificates

- Official opening of the ElsterOnline portal.

- Introduction of ElsterBASIS, ElsterPLUS and ElsterSPEZIAL for voluntary authentication

2006

- The BZStOnline portal based on ElsterOnline technology for portals is available. This makes it possible to electronically transmit notifications in accordance with the Interest Information Ordinance, applications for VAT refunds, ZM, collective applications for refunds of capital gains tax and notifications of actually exempted capital gains

2008

- Transmission option for the corporate income tax return, subcategory 30

- Federal Office for Information Security certifies ELSTER. An ISO 27001 certificate based on the IT baseline protection catalogs of the German Federal Office for Information Security (BSI) documents the successful implementation of information security in accordance with international standards.

- The BZStOnline portal scored 99 out of 100 points (very accessible) in the BIK test (project of the German Federal Ministry of Labor and Social Affairs to make websites more accessible for people with disabilities)

- Possibility of submitting reports under Section 34a EStG, preferential treatment of profits not withdrawn |

- The ELSTER program library "ERiC" is also available for Linux for the first time

2009

Expansion of the offering to include capital gains tax registration in accordance with the EStG

Transmission option for the corporate income tax return, subcategory 31

Customs uses ELSTER certificates for the electronic transmission of the Internet Export Declaration Plus

Transmission option for the declaration for the separate and uniform determination of bases for income taxation, subcategory 90

2010

Expansion of the offering to include capital gains tax registration in accordance with InvStG

Transmission option for the corporate income tax return, subcategories 32 and 33

Customs uses ELSTER certificates for the Internet EMCS application (IEA)

The ElsterOnline portal is being expanded to include forms for §50a EStG

Pilot start of "electronic objection" via the ElsterOnline portal in the states of Bavaria, Saxony and Saxony-Anhalt

Data protection seal of approval for tax data application "ElsterOnline" by the Independent State Center for Data Protection Schleswig-Holstein

Transmission option for electronic balance sheets

2011

- Transmission option for the declaration for the separate and uniform determination of bases for income taxation, subcategory 95

The ELSTER program library "ERiC" is also available for Mac OS X for the first time

Transmission and retrieval of electronic wage tax deduction features, ELStAM

The declaration for the separate and uniform determination of bases for income taxation for up to 10 participants can be submitted via the ElsterOnline portal

The income surplus statement EÜR can be submitted via ELSTER

2012

Unlimited and limited taxpayers can also submit their income tax via ELSTER

The corporate income tax return can be submitted via the ElsterOnline portal

Transmission option ZMDO

The new ID card can be used with ELSTER for registration in the ElsterOnline portal

Transmission option for the income tax return of persons with limited tax liability, subcategory 12

2013

The income tax return can be submitted via the ElsterOnline portal

All functions of the ElsterOnline portal, including registration, are possible without Java

2014

The pre-filled tax return, also known as "document retrieval", is offered

Connection to the power of attorney database of the Chamber of Tax Consultants

Possibility of submitting corporation tax returns without a main form and VAT returns (subcategory 50) in the ElsterOnline portal

The income surplus statement (EÜR) can be submitted in the ElsterOnline portal

2015

Extension of the document retrieval of the pre-filled tax return to include wage replacement benefits

Application according to §34a EStG (preferential treatment of non-withdrawn profit) available in the ElsterOnline portal

Trade tax return and tax registration questionnaire for sole proprietorships in the ElsterOnline portal

Registration according to §50 a VII EStG

Declaration on the breakdown of the trade tax assessment amount in the ElsterOnline portal

2016

Display of income tax assessment data directly in the ElsterOnline portal

Regular user experience (UX) tests with users have begun

2017

Relaunch of the ElsterOnline portal for ELSTER, your online tax office with the new personal My ELSTER area. Responsive web design enables convenient use of the online tax office even with mobile devices such as tablets and smartphones.

New services such as the message to the tax office expand the My ELSTER offering

2018

Mein ELSTER scored 95.75 out of 100 points in the test procedure for accessible web content in accordance with BITV and has therefore been awarded the title "very accessible".

Registration in Mein ELSTER possible with new ID card without certificate file

Possibility of transmitting questionnaires for tax registration when setting up a corporation in Mein ELSTER.

2019

- Request for extension of deadline

- Application for adjustment of advance payments

- Change of address

- Change of bank details

- Other message to the tax office

2020

- Tax relief due to the impact of the coronavirus

- Digital income tax assessment

- Transmission of digital documents, subsequent submission of documents for tax returns

ELSTER is "at the cutting edge" and has been proving this for over 20 years with the consistent development of

and continuous expansion of the electronic offering.

ELSTER - a major contribution to the digitalization of administration

ELSTER, a joint eGovernment project of the German tax administrations of all federal states

The requirements for secure, legally binding dialog between the state and citizens (G2C) or the state and businesses (G2B) exceed the requirements for commercial portals in many respects. The focus of the ELSTER process has therefore been on these requirements since the start of the project:

- To enable electronic communication with the tax administration throughout Germany at any time and from any location and to make this as simple and convenient as possible with the lowest possible access barriers and uniform support for all standard user systems on the market;

- To ensure the highest level of protection and security for the transmission of confidential data so that it meets the high legal requirements for IT security and tax confidentiality. To this end, genuine end-to-end protection of user data is used on the basis of reliable authentication of users at all times in accordance with the protection requirements appropriate to the desired Service. The processes and infrastructure are regularly checked for data protection standards. In 2008, ELSTER received the ISO 27001 certificate for the first time, which documents the successful implementation of information security in accordance with international standards, and in 2010 the Schleswig-Holstein data protection seal of approval for the "ElsterOnline Client Server" architecture;

- To provide users with a future-proof, robust and highly scalable multi-layer architecture for infrastructure and software technology based on proven, international technology standards, using license-free open source products as far as possible and supporting all relevant market standards and technology innovations, including the integration of mobile devices.

ELSTER is "at the cutting edge" and has been demonstrating sustainable continuity for over 20 years with the consistent development and continuous expansion of its electronic offering. ELSTER's approach, which is based on open, platform-independent architecture concepts and technology standards, enables the timely use of technological innovations and support for new interfaces. For citizens and companies, ELSTER supports all market-relevant IT standards for Internet communication without restrictions on technology types or communication paradigms (file transfer, client-server, web technology, synchronous and asynchronous processes) and without manufacturer focus or exclusion (all market-relevant Client systems and web Browsers products in all relevant combinations). Forward-looking IT technology developments such as smartphones and Tablets are integrated, supported and used promptly in the tax administration's offering for the respective user groups.

In addition, the electronic tax return is the basis for end-to-end automation-supported case processing and the efficient use of IT-supported risk management systems. Paper-based procedures are gradually being replaced and instead IT-based procedures are being developed and permanently modernized for all phases of the taxation process wherever possible. With the "TUKAN and TOKO" project, the creation of the specifications for the online forms and the creation of the print templates for the paper forms can also be carried out digitally without media discontinuity as part of the "modernization of the taxation procedure" since 2019.

ELSTER responds to the special requirements of its target groups

In order to meet the diverse requirements of the various user groups and parties involved in the ELSTER process, the processes and technologies of ELSTER are constantly being scrutinized, continuously improved and optimized.

Expansion of the electronic offering

The range of services offered by ELSTER has been expanded and developed step by step in line with user needs, so that 10 types of document are now also supported with the new pre-filled tax return service introduced in 2014. With the tax account query and employee information on ELStAM (electronic wage tax deduction features), citizens are offered a purely electronic service as an add-on. This also includes the provision of a certificate-secured personal mailbox in Mein ELSTER for all users.

Low access and usage barriers for all user groups

Users receive barrier-free, platform-independent and location-independent access to the administration, which is available around the clock, seven days a week.

Ensuring accessibility

The tax authorities attach great importance to the accessibility of their website for all citizens. The result of the BITV accessibility test confirms this: with 95.75 out of 100 points, "ELSTER, Ihr Online-Finanzamt" is rated as "very accessible".

Platform independence made easy

ELSTER supports all market-relevant access technologies and user systems in a broad form without focusing on specific manufacturer variants. In principle, ELSTER can be used with all operating systems.

Free choice of Client Software

ELSTER is available free of charge via ERiC to all Software providers who wish to integrate ELSTER into their products. This means that, apart from a standard computer and Internet access, no further technical requirements need to be met.

Systematic user surveys and derivation of user interface improvements

The constant optimization of "ELSTER, your online tax office" allows the administration to break new ground. "User Experience Tests" - this method is used to test planned innovations for suitability and user-friendliness live on test subjects. Since 2014, such preliminary tests have been carried out using rapid prototyping. This approach allows direct feedback from users to be obtained and implemented. This ensures that the respective innovations are understandable and intuitive and ultimately represent a real improvement in terms of greater user-friendliness.

Another lever for understanding the needs of the individual target groups even better and an important input factor in the development of innovations is targeted knowledge transfer. Lessons learned from the feedback evaluation of the 1st Level Support (Hotline) as well as feedback from the user forum and the ElsterBlog provide information on further needs for action with regard to the user-friendliness of the service.

Ensuring maximum security standards and data protection

Tax data is a matter of trust and therefore secure data transmission is a top priority. For ELSTER, this means that the data must be encrypted accordingly and reliably authenticated. The consideration of target group-specific requirements is reflected in a wide range of possible security standards (certificate file, security stick and signature card), which can be selected depending on the user's need for protection and the services they require. ELSTER gives users the choice between several authentication levels, including the use of signature cards. It is also possible to use the new ID card.

Benefits Management

The survey results of the study from the 8th eGovernment MONITOR on the current eGovernment situation in Germany confirm the acceptance of the ELSTER service by users and the success of the efforts to focus on the target groups. In contrast to the other eGovernment offerings included in the study, the acceptance of ELSTER from the citizens' perspective even increased further in 2017. In Germany, the electronic tax return (Elster) alone was able to gain more users with an increase of 4 percentage points to 40 percent. From a citizen's perspective, this service has been continuously developed and simplified.

Cost, time and quality benefits for ELSTER users

The electronic tax return enables modern, fast and seamless communication and simplifies the completion and transmission of tax returns. It is also a prerequisite for end-to-end automation-supported case processing and the efficient use of IT-supported risk management systems. Overall, it contributes to significantly faster processing by the tax administration.

The further expansion of electronic communication simplifies and reduces tax declaration obligations. Transparency regarding the tax-relevant data already available to the administration often eliminates the need for time-consuming fact-finding. The extensive elimination of document submission requirements reduces the number of steps involved in submitting returns and speeds up the process. The scarce resource of time is conserved.

The advantages of electronic tax returns are clear:

- The tax return software adopts the previous year's values and the data available to the tax office can be transferred directly to the tax return using the certificate retrieval function (pre-filled tax return).

- Plausibility checks indicate missing information as soon as it is entered. This prevents transmission errors and reduces the number of queries from the tax office.

- Immediate feedback on the tax result after the tax return has been prepared offers transparency and security for taxpayers.

- The highly secure data encryption and transmission ensures trust in the handling of sensitive data.

- Shorter processing times and therefore faster feedback to all user groups are possible, as the electronic tax returns can be processed more easily.

Influence on society and the solution of important future issues

Reduce bureaucracy and streamline administration

In order to meet current and expected future challenges for an efficient and sustainable taxation procedure, communication processes and workflows in the taxation procedure are to be structurally redesigned. The mass taxation procedure must be realigned with the help of increased use of IT in order to ensure that tax administrations perform their tasks in a citizen-friendly, effective and economical manner.

For people with disabilities, Mein ELSTER offers unrestricted access to all electronic services and content. The Ordinance on the Creation of Accessible Information Technology under the Disability Discrimination Act (BITV) was used as the basis for the barrier-free design of the portal. "Very accessible" is the test result for "ELSTER, your online tax office" with 97.25 out of 100 points in the BITV accessibility test.

Ensuring uniformity of taxation

The electronic tax return enables an automatic, automated comparison of the tax assessment data with the declared tax bases. Any discrepancies between the tax office and the data in the tax return can be quickly and easily tracked. In this context, the plausibility check and the calculation of the expected tax, which ELSTER makes possible, represent particular added value for taxpayers. This increased transparency is an essential step towards ensuring uniform taxation.

Cost, time and quality benefits for tax administration

The aim of the electronic tax return is to make processes more efficient and thus gradually reduce the workload and costs for the administration. For example, media disruptions are avoided, search processes are simplified and public administration traffic is reduced.

In 2020, with 28.2 million electronically transmitted income tax returns, ELSTER enabled the tax administration to significantly reduce the effort required for data entry and thus relieve staff of routine tasks and error corrections - away from routine and towards more demanding tasks. This results in lower error rates, shorter processing times and therefore higher (service) quality, which ultimately benefits taxpayers. Despite the increasing number of electronic tax returns, the administrative authority's resources have been kept at the same level.

The methods for ensuring uniform, fair and lawful taxation will be further developed. In future, the taxation procedure is to be designed to be even more consistently risk-oriented in order to process the largest possible number of tax returns in the mass procedure with significantly lower personnel costs, ideally fully automated. Low-risk tax cases can thus be processed more easily and quickly. Issues with significant tax risks can be checked more effectively and in a more concentrated manner at the tax office. The tax administration is consistently pursuing the goal of fully automating around 50% of tax returns and processing around 30% of tax returns with little checking effort in the coming years. This will significantly reduce processing times once again and allow the administrative officers to concentrate on intensive audit cases. These improvements are based on the digital tax returns made possible by ELSTER.

Improvement and simplification of legal and political task fulfillment

For taxpayers, "audit fairness" is the key issue when it comes to tax returns. Transparency and acceptance - this is what needs to be achieved. The electronic tax return and the approach of automated assessment notices play a key role in achieving this goal.

The electronic tax return makes it much easier for users to enter data: immediate feedback when entering incorrect or incomplete information as well as help functions that take immediate effect if anything is unclear. Since the introduction of the pre-filled tax return, taxpayers have received even more support. The new Service enables the tax administration to provide information and document data that is already available electronically, thus further reducing the effort involved.

The more automation-supported tax returns can be processed in the mass procedure with significantly lower personnel costs, the more scarce resources can be conserved and capacities can be made available efficiently for intensive audit cases. The automated evaluation of tax returns guarantees objective and transparent processing. This ensures the uniformity of taxation.

Effects on the digitalization of administration

A modern, fully electronic taxation procedure is bureaucracy reduction and tax simplification in its purest form and, in the view of the Federal Government, is a modern tax administration in the age of the 21st century and in a "modern state". The aim is to make the tax administration more efficient and its services, service quality and procedures simpler, faster and more customer-friendly. At the same time, eGovernment has a further role to play: the state becomes a promoter of future technologies and secures the necessary information technology (IT) infrastructure. By using innovative and new technologies, it becomes a driving force and a partner of the economy. Due to its immense reach and number of users, the ELSTER project is an essential component of this goal by continuously driving forward the modernization of tax administration in the sense of electronic and paperless communication.

ELSTER corporate account, eGovernment powered by ELSTER

Unlike in many other countries in Europe and around the world, companies in Germany do not have a digital identity. However, this is also the case for most citizens. Although more than half of Germans now have a new (electronic) ID card, the number of people who actually have a usable digital identity is in the single-digit percentage range if you take into account the spread of the eID and the necessary ID card readers. This is clearly at odds with most digitization projects in Germany: these inevitably require an electronic identity. And most digitization projects only work economically if there is a critical mass of users who use the planned online services. This critical mass cannot be achieved in the medium term with the ID card, and companies can hardly hope for an electronic seal in the near future. The requirements for a digital identity and the hurdles in daily use in relation to the benefits are far too high today.

With the Mein UNTERNEHMENSKONTO Unternehmenskonto a project within the framework of the tax administration's ELSTER procedure, the critical mass can be achieved while at the same time creating a user-friendly application that is established in everyday life for all citizens and every company. And in the short term and relatively inexpensively!

Pre-filled tax return

The pre-filled tax return (VaSt) is a free service provided by the German tax administration with the aim of making it easier for citizens to prepare their income tax return. The pre-filled tax return, also known as document retrieval, has been available since January 2014.

The starting point for the introduction of the pre-filled tax return is the tax administration's efforts to modernize the taxation process. The focus is on improving the quality of tax enforcement and reducing bureaucracy for citizens, companies, tax advisors and the tax administration. In order to achieve these goals, a new service - the pre-filled tax return - will be made available to all citizens on request using the document data already available electronically from the tax administration

Data provided and its use

The following documents stored by the tax administration are provided by the pre-filled tax return:

- wage tax certificates sent by the employer,

- Notifications regarding the receipt of pension benefits,

- Contributions to health and long-term care insurance,

- Pension expenses (e.g. Riester or Rürup contracts)

- Wage replacement benefits (e.g. sick pay)

- Notification of capital-forming benefits

- Master data.

It is planned to make further documents and data available for retrieval in future expansion stages of the Service. With the document retrieval, the data mentioned can be displayed and also automatically transferred to the corresponding fields in the income tax return. Even if the receipts have been retrieved and, if necessary, the fields in the income tax return have been pre-filled, the data can still be changed or deleted afterwards. If the displayed receipts are incorrect or incomplete, they must be corrected independently by contacting the relevant data provider directly, e.g. the employer or health insurance provider. Correction by the tax office is not possible.

The income tax return can be prepared in Mein ELSTER or with other tax software programs. The tax office cannot determine after the income tax return whether and to what extent retrieved data has been used or changed. There is no obligation to submit the income tax return electronically when using the document retrieval service.

Availability of data/documents

The pre-filled tax return has been available since January 2014. The documents provided to the tax authorities by the data transmitters (employers, insurance companies, etc.) can be retrieved at any time. The statutory deadline for submission by the data transmitters is February 28 of the respective year.

The data for the years from 2012 onwards can be retrieved. The documents are then offered for data retrieval for four years and deleted again after this period has expired. The data can be retrieved around the clock, seven days a week and repeatedly even after the respective income tax return has been submitted.

Prerequisite for use

The data from the above-mentioned documents is not automatically collected for all taxpayers. The prerequisite for retrieval is a valid registration with the tax identification number (tax IdNr.) in Mein ELSTER and then the (separate) registration for document retrieval. The data will then be available one day after registration at the earliest.

Document retrieval for/from third parties

It is also possible to retrieve data on behalf of/from other persons or to authorize persons, such as spouses or tax advisors, to retrieve documents. To do this, a corresponding request must be made in the private area of "ELSTER, Ihr Online-Finanzamt" (My ELSTER) or with the tax software, which can then be approved by the data owner.

Retrieval code

When using the Mein ELSTER registration with software certificate, you need a so-called retrieval code to participate in the pre-filled tax return. This serves as an additional security feature alongside the PIN. The tax authorities will automatically send you a retrieval code by post (exception: a valid retrieval code already exists).

Activation code

The activation code is a 12-digit key to be used once to activate an authorization request. You need the activation code to authorize another person (e.g. your spouse or income tax assistance association) to retrieve third-party receipts. For example, the spouse must submit an application for the tax IdNr. of their partner. The tax authorities will then send them a letter with an activation code, which can then be passed on to the applicant if desired.

Viewing the vouchers

Receipts can be retrieved and viewed in Mein ELSTER without having to use them in the tax return.

Security

Maintaining tax confidentiality is the top priority with the pre-filled tax return. To protect this, the tax data is transmitted to the tax authorities in encrypted form.

All technical requirements and infrastructures for ELSTER are already in place

and have been used by millions for years.

ELSTER - the technical concept

The focus of the architecture is on comprehensive security, flexibility, robustness, scalability and openness, free from technology lock-in. These goals are achieved through overarching architectural principles, among other things:

- Use of open standards, standardized interface technologies (especially XML documents) and the use of products from open source projects (e.g. Tomcat, PostgreSQL, or Hadoop)

- Selection of the communication mode suitable for the application (synchronous or asynchronous communication) for high-performance data transfer between all partners

- Component selection, based on a dual-vendor strategy

- Use of modern virtualization technologies to create and operate a flexible and scalable IT infrastructure

- Ongoing BSI certification to guarantee the security requirements of the current IT landscape

This open and platform-independent approach enables ELSTER to react quickly to technological innovations and implement them. The focus here is on the digital sovereignty of the state through the almost continuous use of open source components.

To ensure that platform independence can continue to be guaranteed in the future, Java is used as the preferred programming language on the server side.

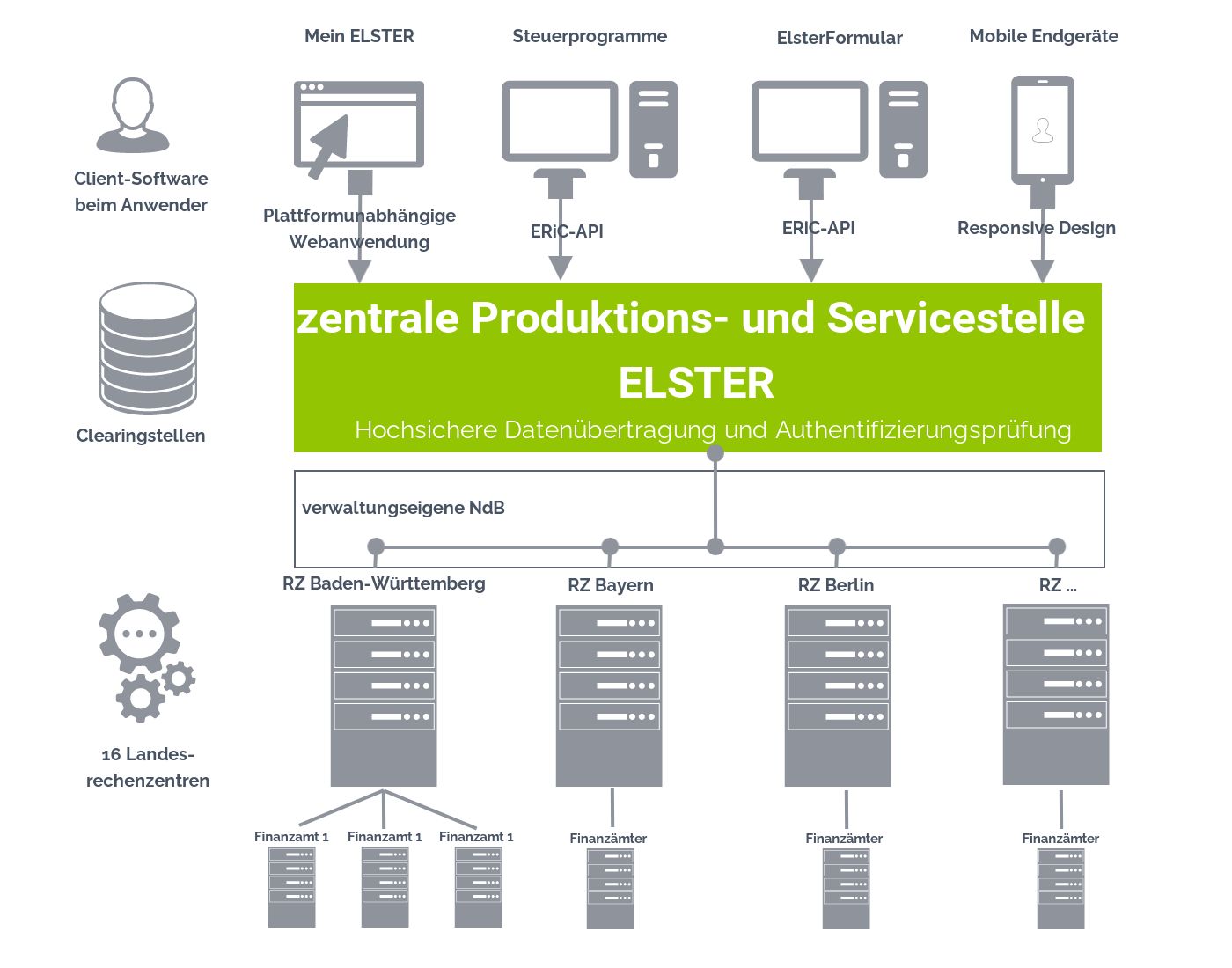

Secure data transport through the 3-level model / from citizens to tax officials

Data is exchanged between citizens and the tax authorities via XML standards, whereby the tax data entered by users is stored as an XML document and transmitted to the data centers of the federal states via the central production and service point ELSTER Kommunikation and from there to the relevant tax office. This transmission always takes place using hybrid encryption (TLS 1.2 with PFS) and in accordance with the principles of basic protection (confidentiality, integrity and availability).

To ensure that the tax data reaches the relevant tax office reliably and securely, ELSTER is divided into three levels:

The Client

At this level, users are authenticated by means of a certificate, security stick or ID card. Once users have been authenticated, the tax data can be entered without barriers and, after being checked for completeness and plausibility, can be secured and signed before being transmitted.

The plausibility check in the Client is based on current tax legislation. For this purpose, the legal framework is modeled in data models and the set of rules is recorded via a DSL (Domain Specific Language) and made available centrally in a repository. Libraries in Java, C++, JavaScript and Visual Basic for Applications can be generated from this repository and used on the client side to check the data entered. It also provides information that the Mein ELSTER portal needs to display the forms in the Browser and the help texts.

Due to the annual changes in tax legislation, the repository has a volume of over 150,000 rules with several million rule versions entered and approx. 300,000 fields with several million field versions entered.

The checked data is transferred to the next level, the Central Production and Service Center ELSTER Communication.

The central production and service point (ZPS) ELSTER Communication

As the central point of the ELSTER infrastructure, the ZPS ELSTER Communication located in Nuremberg is the nationwide access point for the electronic dialog of all parties involved in the procedure. Externally, it guarantees the security and availability of access and data transmission and authenticates users. Internally, it ensures the reliable and secure distribution and forwarding of data to the relevant data centers of the federal states.

The scalability of ZPS ELSTER communication is achieved by using virtualization technology based on KVM (Kernel-Based Virtual Machine) in order to be able to react simply and easily to sudden increases in load requirements. Regular load tests ensure the scalability of the architectures and technologies used for Mein ELSTER and the distribution processes in the ZPS.

In addition, the Mein ELSTER services and the underlying specialist processes are successively expanded and the latest technologies integrated in three annual releases.

The regional data centers

The 16 state data centers and the Federal Finance Administration are connected to the ZPS ELSTER communication via internal networks of the authorities. To ensure confidential communication between the ZPS Elster communication and the connection nodes of the federal states, this takes place via secure VPN tunnels. At these connection nodes, the transmitted data is converted into the file formats required for the state-specific processing systems and persisted in the local databases so that the clerks at the responsible tax offices can access the tax data.

ELSTER as a technology driver in public administration

As a digital administrative service, Mein ELSTER must be usable for all citizens, which is why particular attention is paid to accessibility and accessibility. To use Mein ELSTER, all you need is a standard end device with one of the free Browsers available (see System requirements). In addition, the ERiC (ELSTER Rich Client) program library enables tax software providers' products to communicate directly and securely with ELSTER. ERiC currently supports around 200 software partners with around 500 programs and several million users.

In addition, the focus is increasingly shifting to mobile devices, such as ElsterSmart for user authentication.

The technological standards and architectures on which ELSTER is based are based on SAGA-compliant (Standards and Architectures for eGovernment Applications) solution approaches. These are implemented on the basis of modern and lean technologies such as Springboot and Tomcat. The document-centered communication between the parties involved is based on XML technology. The web services used for communication with internal and external interface partners are based on standardized interfaces such as SOAP and REST.

A big data approach based on Hadoop and Solr is being implemented for central logging with a total of around 30 billion log messages.

The security of authentication and data transmission plays a major role. This is due to the high number of users, the legal requirements and tax confidentiality. The high security requirements for ELSTER are implemented in compliance with national and European data protection laws and the guidelines of the German Federal Office for Information Security (BSI), with implementation certified to ISO 27001.

Elster's own PKI (Public Key Infrastructure), which issues the user certificates, uses the common PKCS (Public Key Cryptography Standards) and PKDF2. Communication is encrypted using TLS 1.2 (PFS) for all data transmission from the Browsers to the Server.

ELSTER - the organizational concept

Organizational measures accompanying the project

In order to realize a project of the size of ELSTER and the associated scope of tasks in as flat a hierarchical structure as possible, an overall project management team consisting of the process manager, his deputy, architects and multi-project and quality management was established. They are in regular contact with the committees responsible for the KONSENS process.

In order to ensure the flow of information within the tax administration, there are ELSTER representatives in each federal state, as well as ELSTER officers in the individual tax offices. The state representatives and the BMF representatives meet regularly in the "ELSTER process deployment" (VE) committee, based on the ELSTER release cycles, to discuss innovations and future plans. In their role as multipliers, the state representatives pass on information to the ELSTER representatives and, in return, contribute their experiences and suggestions to the VE meetings.

The tax offices are also connected via their own intranet, which gives employees of the tax authorities constant access to all important information on ELSTER, such as regularly updated guides, training documents and information folders. In addition, electronic tax returns are now an integral part of training for tax officials.

A three-tier support system has been set up to ensure that not only the employees at the local tax office can provide information and assistance on ELSTER at any time, but also that users can be offered quick and competent support around the clock. The most visible level for users is 1st Level Support, consisting of the tax offices with the respective ELSTER representatives and the ELSTER hotline. This is followed by 2nd level support with the ELSTER support in Lower Saxony and 3rd level support, consisting of development and operations.

Tool-supported processes, e.g. error management, problem handling and operational project management, support cross-country and cross-project collaboration between the numerous project participants throughout Germany.

Legal framework conditions that had to be changed or simplified.

The Tax Data Transmission Ordinance (StDÜV) was the legal basis for electronic data transmission via ELSTER. The Ordinance on the Automated Retrieval of Tax Data (StDAV) was amended in 2005 to enable pre-filled tax returns. The regulations have since been incorporated into the AO.

In a next step, the legal measures required to further modernize and digitalize the taxation process were introduced into the legislative process at the beginning of 2015 and have been effective since 2016.

These are based on a joint concept for the "modernization of the taxation procedure" by the federal and state governments.

The following statutory and sub-statutory measures are intended to comprehensively expand electronic communication between the tax authorities, taxpayers and authorized representatives:

- In order to improve the service quality of the electronic tax return, receipts and supplementary documents for the tax return can be transmitted electronically via ELSTER.

The improvements to ELSTER also include the existing pre-filled tax return service.

Since then, electronic communication has not only extended to the submission of tax returns, but also increasingly to the exchange of other formal notifications to the tax office, e.g. applications or other letters.

With the taxpayer's consent, tax assessments can also be issued electronically in a legally binding manner.

- The personal case review of income tax returns is to be concentrated on high-risk matters, taking into account efficiency and expediency considerations. The possibility of using risk management systems was expressly standardized in the German Fiscal Code (AO) and at the same time fully automated case processing was permitted. Ultimately, tax assessments should also be able to be issued fully automatically in suitable cases

ELSTER - portability and learning

"Good practice" for other authorities

Transferability made easy - because ELSTER uses technical developments that are largely application-neutral. When selecting the technologies used, the decision was primarily made in favor of globally used standards and technologies such as Java, PDF (Portable Document Format) or XML (eXtensible Markup Language) as well as open source software. On the one hand, this simplifies the integration of other eGovernment applications into ELSTER. On the other hand, ELSTER offers a good solution and technological basis for all eGovernment projects that want to use forms online, transmit them in a highly secure manner and exchange a wide range of information.

Since 2005, the sister portal BZStOnline of the Federal Central Tax Office, which is based on ElsterOnline technology for portals, has already successfully proven that cross-use works.

Customs also uses ELSTER technology, as ELSTER certificates have been used since 2010 for the electronic and therefore more convenient transmission of the Internet Export Declaration Plus (IAA) and for the Internet EMCS application (IEA). Customs has also been using ELSTER certificates as a means of authentication and identification for the citizen and business customer portal since October 2019. This resulted from the EKONA (ELSTER Account Authentication and Identification Service) project, which the tax administration successfully implemented with the citizen and business customer portal. The authentication solution of the ELSTER procedure is also used in the employee portal of the state of Bavaria and is used in a generic variant as the AUTHEGA solution. This was established in the Free State of Bavaria as a basic component for user authentication in eGovernment projects and has been used since 2014 for the Dienstleistungsportal Bayern, the platform for the Single Point of Contact (EPF).

Experience from other eGovernment/e-business applications and projects

When the project was launched more than 20 years ago, ELSTER was a pioneer for a large eGovernment solution. Apart from the sister portal BZStOnline, there is currently no comparable solution on the same scale and with the participation of all 16 federal states and the federal government.

With the continuous expansion of its electronic offering for users, ELSTER is always open to new developments and on the lookout for opportunities for innovation. To this end, the project managers are not only in regular contact with other German administrations and authorities, but also in close contact with the tax administrations of countries such as Denmark, Austria and Switzerland. In addition, ELSTER is involved in the EU-wide eGovernment project "Digital Agenda 2020" and is a member of the OECD's Forum on Tax Administration Taxpayer Services Subgroup.