What is ELSTER transfer (ETR)?

The ELSTER Transfer (ETR ) procedure is offered to enable special organizations such as municipalities, chambers, universities, regional associations, banks, authorities, institutions or service providers to exchange sensitive data electronically with the tax authorities' data centers and to upload documents to the mailboxes ofusers (individuals/taxpayers/companies).ELSTER-Transfer is an application of the tax authorities, which is usually run permanently on a Server or computer and offers several interfaces for communication between the mailbox at the tax authorities and the Software used at the organizations.

Why the connection to ELSTER transfer?

What motivates an organization to abandon its existing analogue processes and switch to the electronic transmission of data and/or documents instead?First and foremost, the Online Access Act should be mentioned here: The Online Access Act requires the provision of online access to all administrative services. This also includes, for example, notifications for users or companies.

With the interface that was created for provision in April 2021 (version 2.0.0), documents can be placed in the taxpayer's digital mailbox. In this way, ELSTER Transfer can serve as a virtual letter carrier for notifications and legally binding notices that are completely digital.

In addition to the provision of documents, a wide range of data can be exchanged with the financial administration so that many processes can run without media discontinuity. This offers organizations the opportunity to improve processes and workflows and make them more efficient, freeing up personnel capacity that is urgently needed elsewhere. For some local authorities, ELSTER transfer is the first step towards digital administration. For others, it is a further building block towards fully digitalized administration.

You can find a selection of the available procedures on the page Supported ELSTER transfer procedures of the partners .

Data exchange with the tax authorities

The target group are organizations that want to exchange data with the financial administration's data centers. These are predominantly local authorities.Files from the tax authorities are provided as raw data. These are not human-readable and must therefore be prepared and processed using external software. If you wish to exchange data with the tax authorities' data centers ("partners"), you must check (if necessary in cooperation with your software provider) whether the electronically provided data can be processed or created.

In the user manual of ELSTER-Transfer (Windows/Linux) you will find an overview of the file name pattern in the input directory (if you want to retrieve data from the tax authorities) and the options for sending data.

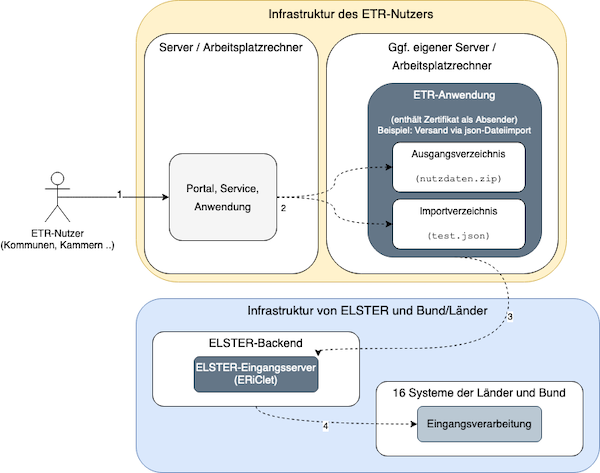

(1) The ETR user (municipalities, chambers, ...) uses its portal or application to generate the data for the financial administration. In this example, the json file import interface is used. Here, a nutzdaten.zip is stored in the source directory and a json addressing file (with sending options) test.json is stored in the import directory of ELSTER-Transfer (2).

The ETR application packs this data into an ELSTER data record and transmits the data in encrypted form via the ELSTER inbound server (3) to the Backend and from there on to the inbound processing (4) of the addressed country (recipient).

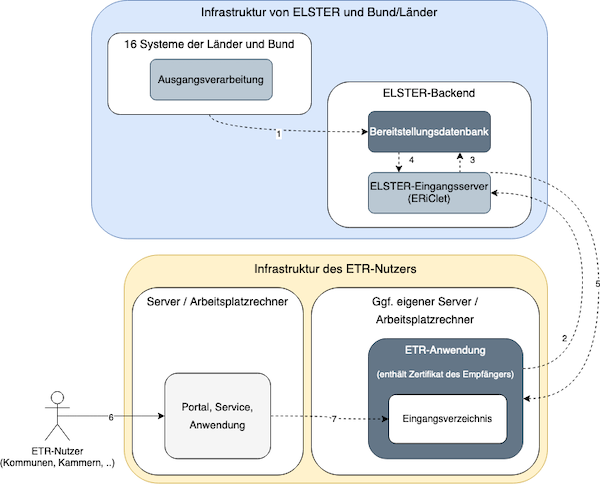

The outbound processing of a federal state (or federal government) enters the data addressed to an ETR user into the provision database of ELSTER via the Backend (1).

The user has created a standing order in ELSTER-Transfer, which periodically checks in the background whether new data is available for him (2, 3). If new data is available, it is downloaded and stored in the input directory of ELSTER-Transfer (4, 5).

The portal or the ETR user's application can periodically check the input directory of ELSTER-Transfer (6, 7) and process new data immediately.

Sending messages or notifications to users' mailboxes

The main target group for this function are Service Providers that are connected to the ELSTER Identity Provider via NEZO.Further information: https://info.mein-unternehmenskonto.de/

An important technical requirement for the provision of notifications or notices is the connection to the ELSTER-Transfer back-channel interface. This interface can be used to transfer administrative acts that are to be announced electronically to the Mein ELSTER and Mein Unternehmenskonto portals. There they are then placed in the user's mailbox and can be retrieved.

It will also be possible for recipients to retrieve these documents via machine-to-machine communication (M2M, ERiC). It will also be possible for the sender to provide links and thus offer the recipient the opportunity to respond directly to administrative acts.

The unique "AccountID" or "User account ID" (or pseudonymized AccountID) of the recipient is used as the addressing feature. Further addressing features (e.g. official municipality key for municipalities) are planned.

To do this, the applications used must be enabled to transfer the documents to ELSTER-Transfer in PDF format. Further information on the interfaces can be found in the Help area.

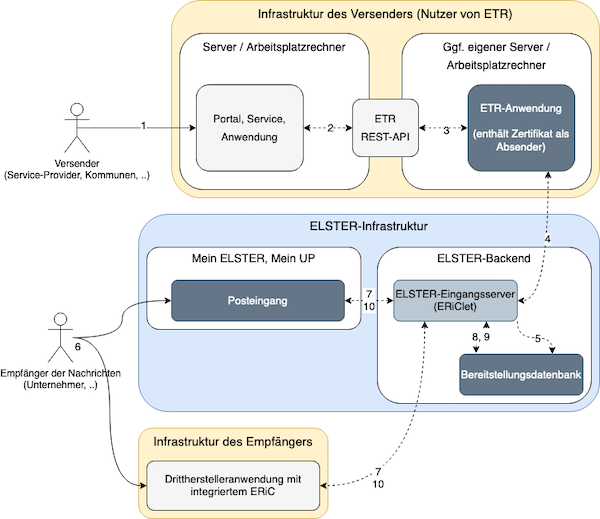

(1) The sender (Service provider, municipality, etc.) uses its portal or application to generate a message. (2) This portal (or its application) uses the ETR-REST-API to transfer the document and other sending options to the ELSTER transfer application (3).

The ETR application packs this information into an ELSTER data record and transmits the data in encrypted form to the ELSTER backend (4). There, the document is stored in the provision database (5) and waits to be picked up by the recipient. From this point on, the ETR application also checks the status of the document (provided, collected, etc.) and can report the status back to the sender's portal/application (5, 4, 3, 2).

The recipient of the message is informed of its receipt. They use the My ELSTER/My UP inbox or their third-party application (with integrated ERiC) to retrieve the message (6). My ELSTER, My UP or ERiC uses the inbox server (7) to ask the provision database (8) whether new documents are available. If this is the case, the message is made available to it (9, 10).